does unemployment reduce tax refund

The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. Why does my unemployment 1099-g lower my refund by 50.

How Unemployment Affects Your Taxes Taxact Blog

Ad File unemployment tax return.

. Because the change occurred after some people filed their taxes the IRS will take steps in the spring. The American Rescue Plan a 19 trillion Covid relief. Unemployment Insurance UI benefits are taxable income but do not count as earnings.

While getting a big tax refund can feel like an exciting windfall the IRS doesnt want you to count on that money too soon. Posted by 8 months ago. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced.

While it may be. If you received unemployment benefits in 2020 a tax refund may be on its way to you. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Unemployment effect on tax return.

This threshold applies to all filing statuses and it doesnt double to. Select the name of the vendor who submitted the refund check. Dont bank everything on an incoming refund.

A quick update on irs unemployment tax refunds today. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. Unemployment effect on tax return.

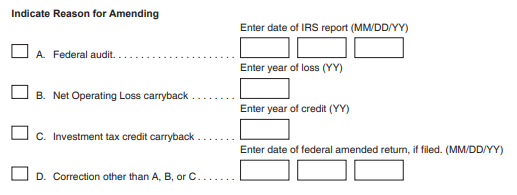

The legislation excludes only 2020 unemployment benefits from taxes. Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities.

A tax refund which occurs when a tax filer overpays their federal income. Federal agency non-tax debts. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

If you are receiving unemployment benefits check with your state about. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Collecting Full Unemployment Benefits May Affect Your Tax Return

Irs Sends Out 4 6 Million Refunds To Taxpayers For Overpayments Wfmynews2 Com

What Is Irs Treas 310 And How Is It Related To 2020 Tax Returns As Usa

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

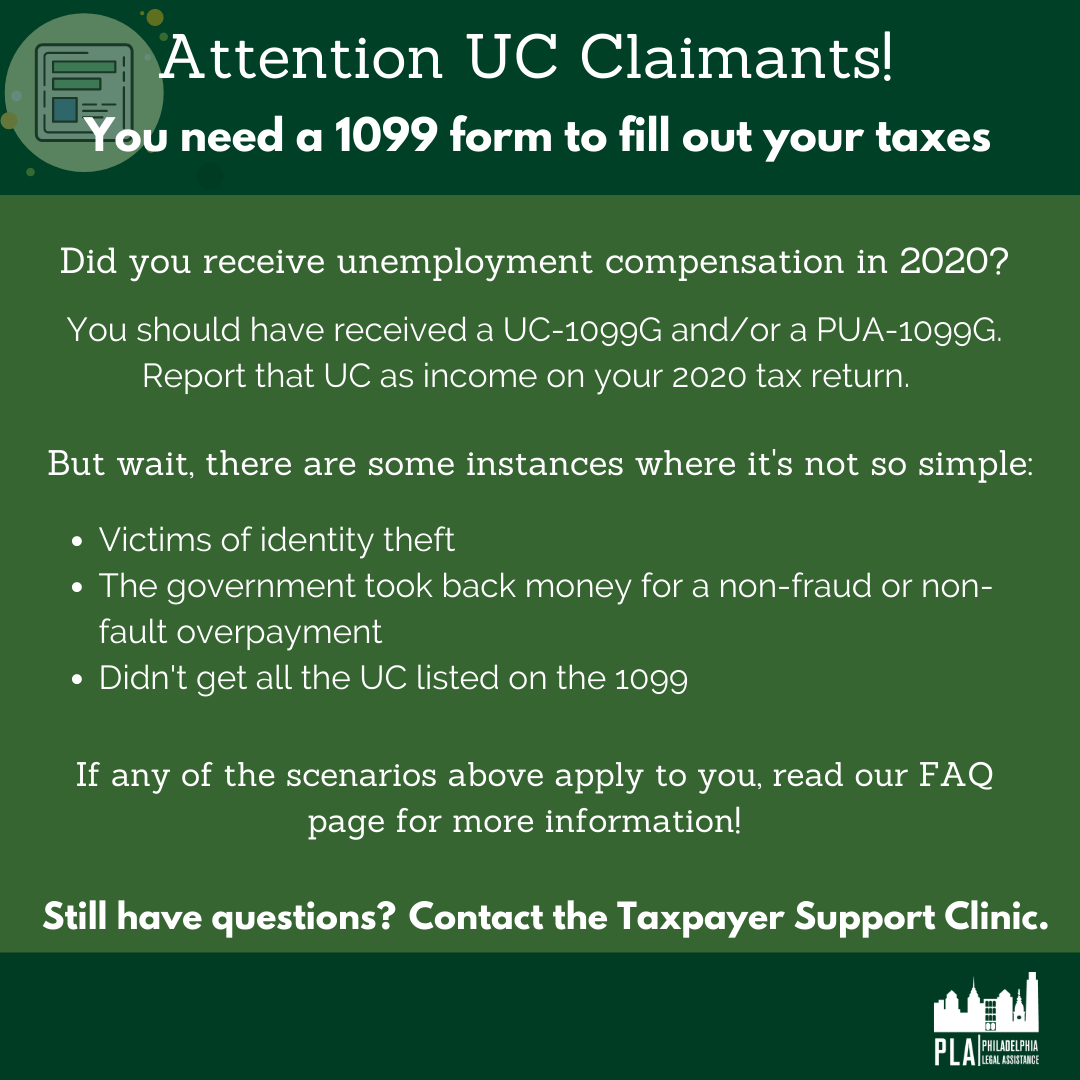

Taxes And Unemployment Compensation What You Need To Know Before Filing Philadelphia Legal Assistance

Unemployment Tax Break Update Irs Issuing Refunds This Week Wfaa Com

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Tax Refunds For 10 200 Unemployment Break To Start In May What You Need To Know Fox Business

Unemployment Refunds Are Coming Everyone R Irs

View All Hr Employment Solutions Blogs Workforce Wise Blog

/income-tax-refund-d491f056bdb64ae495a2d33eaa61f593.jpg)

6 Ways The Irs Can Seize Your Tax Refund

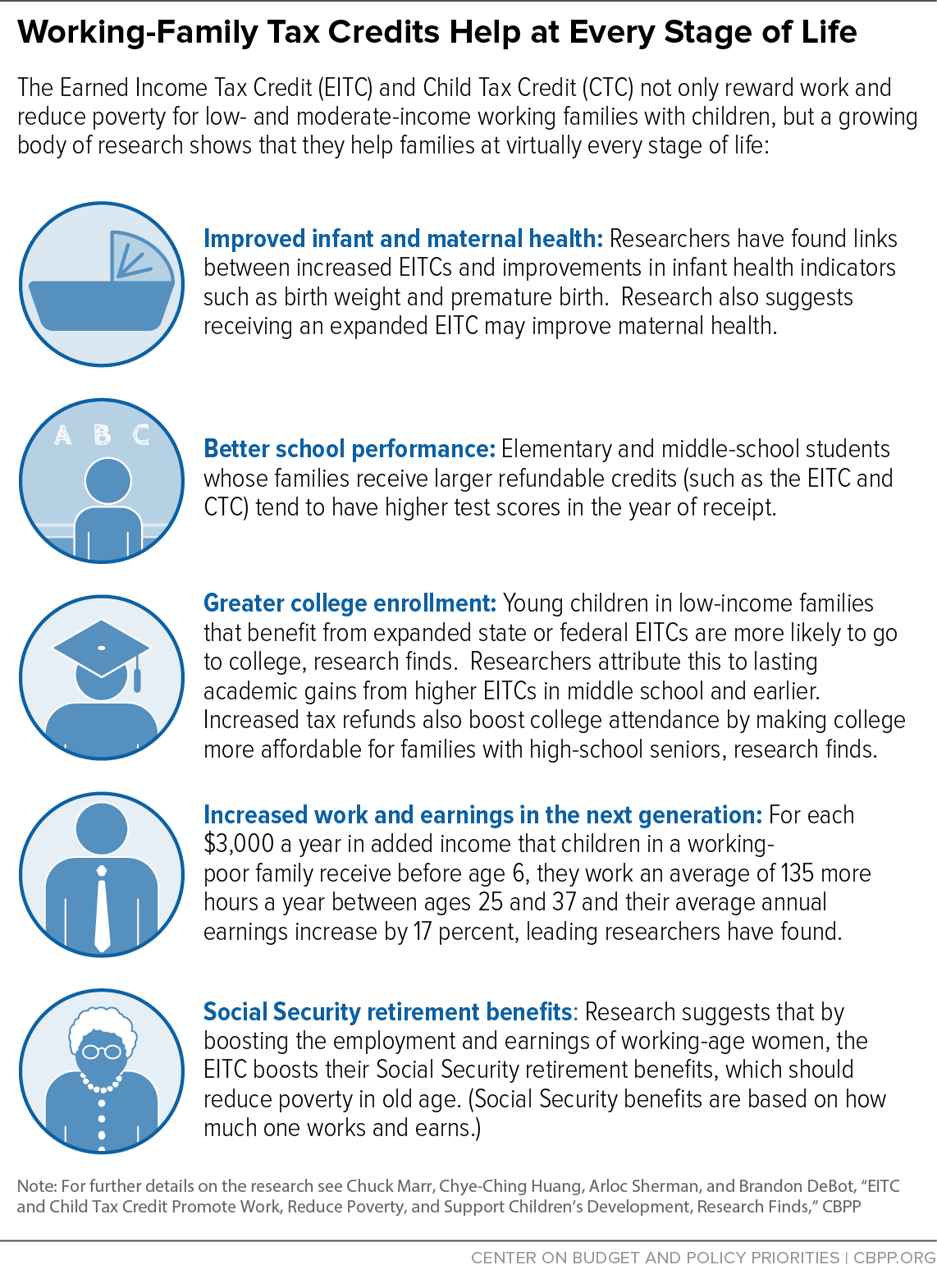

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

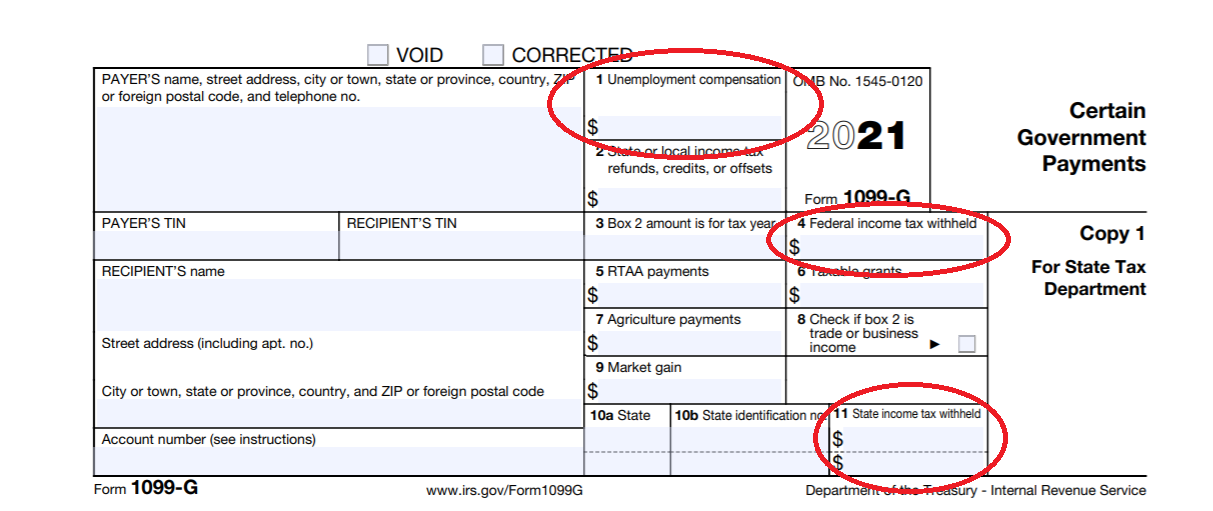

Tax Form Arriving Soon For Unemployment Program Claimants Lower Bucks Times